Hi everyone.

I was inspired by the dynamic release of Minswap.

I am the person who presented the Staking Plus proposal and if you do not know it, I invite you to see that proposal.

MY PROPOSAL:

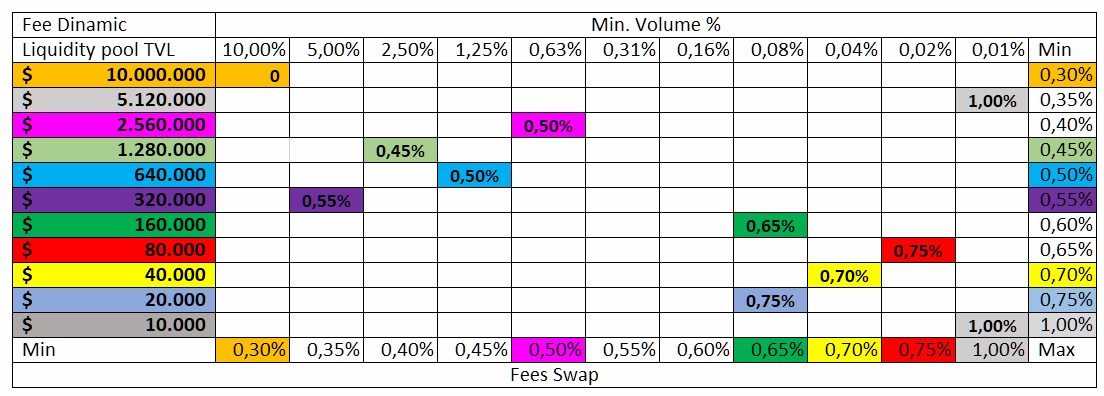

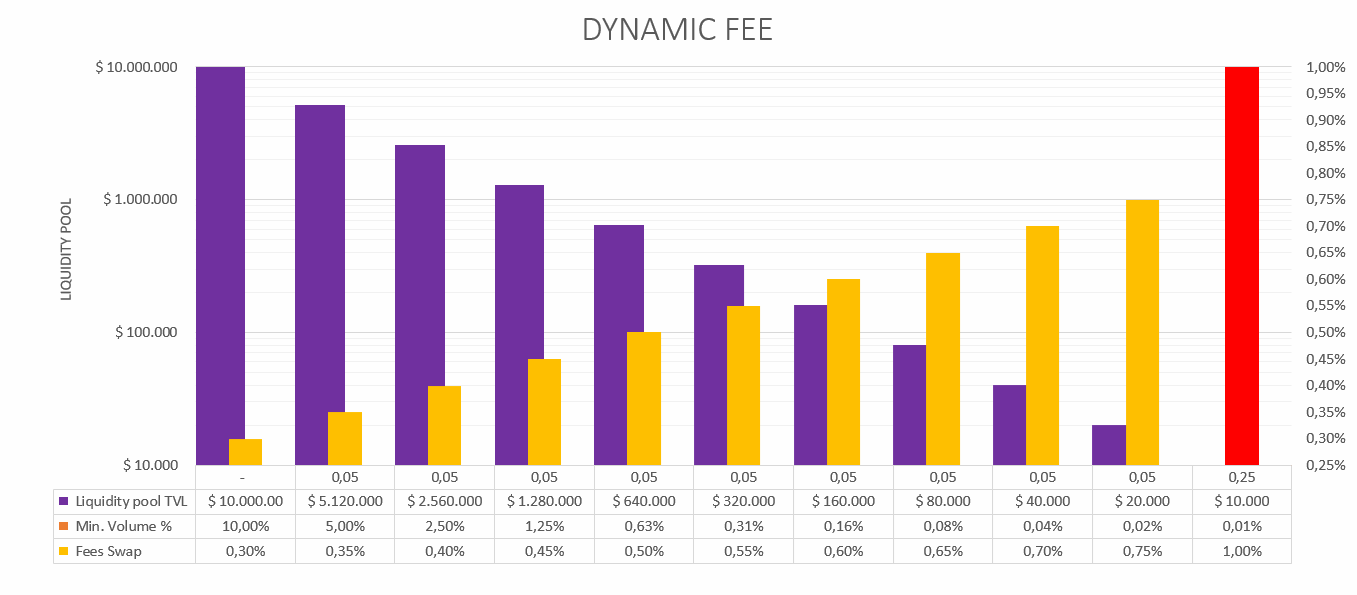

The goal of this proposal is to improve market efficiency in decentralized exchanges (DEXs) by using dynamic, tiered fees based on both volume and liquidity. The idea is that fees will change every 5 days based on the relationship between volume and liquidity in the specific asset pair, and the amount of liquidity in the market, with the goal of incentivizing liquidity providers to add new pairs and increase liquidity in existing pairs.

The increase in fees is based on the Bitcoin halving algorithm, which allows for a gradual transition in fees as volume in relation to liquidity decreases. This helps balance incentives for liquidity providers and users, as liquidity providers receive a lower fee when volume is high in relation to liquidity, and when there is high liquidity in the market.

The increase in fees is based on the Bitcoin halving algorithm, which allows for a gradual transition in fees as volume in relation to liquidity decreases. This helps balance incentives for liquidity providers and users, as liquidity providers receive a lower fee when volume is high in relation to liquidity, and when there is high liquidity in the market.

The benefits of this proposal include:

- Improving market efficiency: By incentivizing liquidity providers to add new pairs and increase liquidity in existing pairs, spreads are reduced and market efficiency is improved.

- Balancing incentives: By setting dynamic fees that change based on both the relationship between volume and liquidity and the amount of liquidity in the market, incentives are balanced for liquidity providers and users.

- Gradual transition: By basing the increase in fees on the Bitcoin halving algorithm, a gradual transition in fees is allowed as volume in relation to liquidity and liquidity in the market decreases. This helps avoid sudden changes in fees and reduces uncertainty for users.

Transparency: By informing users about expected fees before making a transaction, transparency is promoted and confusion is avoided.

Stimulation for innovation: By providing incentives for creating new asset pairs and improving liquidity, innovation in the DEX market is promoted.

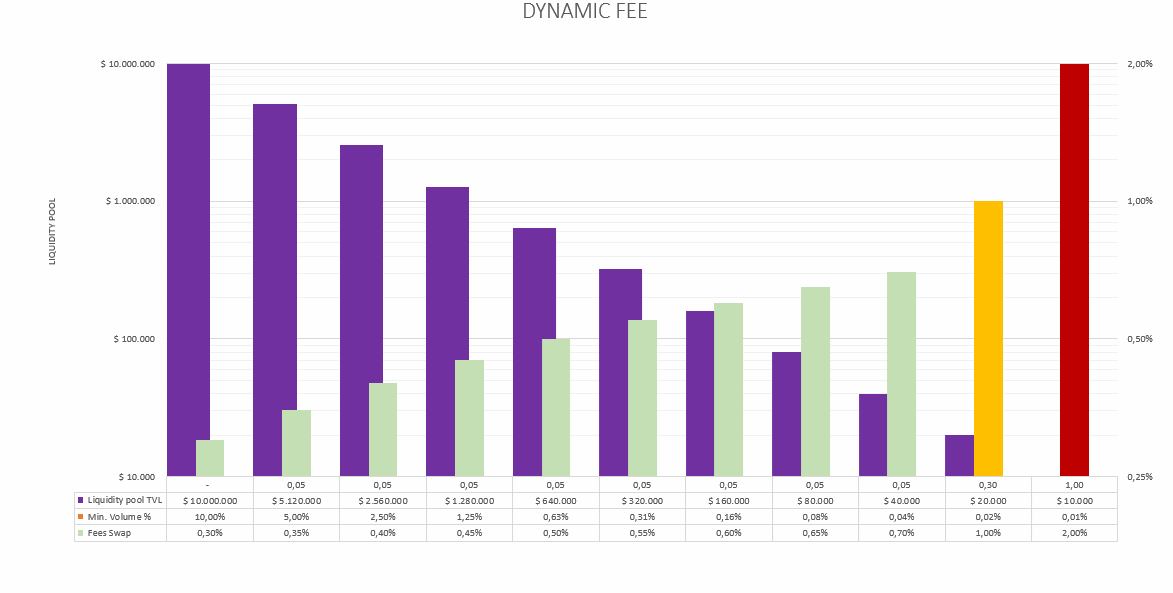

Examples of how the fee based on the relationship between volume and liquidity and the liquidity in the market could be tiered according to the Bitcoin halving algorithm:

Example 1: The ADA/USDC asset pair has a fee of 0.3% if weekly volume is above 10% of the $1 million liquidity and if market liquidity is above $1 million. If weekly volume is below 5% or market liquidity is below $500,000, the fee increases to 0.35%. If weekly volume is below 2.5% or market liquidity is below $250,000, the fee increases to 0.4%. If weekly volume is 0% or market liquidity is below $10,000, the fee increases to 1%.

Example 2: The iETH/MIN asset pair has a fee of 0.5% if weekly volume is above 15% of the $500,000 liquidity and if market liquidity is above $500,000. If weekly volume is below 7.5% or market liquidity is below $250,000, the fee increases to 0.6%. If weekly volume is 0% or market liquidity is below $10,000, the fee increases to 1%.

In summary, this proposal aims to improve market efficiency in decentralized exchanges by using dynamic, tiered fees based on the relationship between volume and liquidity, and the liquidity in the market, based on the Bitcoin halving algorithm. This would help balance incentives for liquidity providers and users, as well as promote transparency and innovation in the DEX market.

Here are some graphs that explain it better

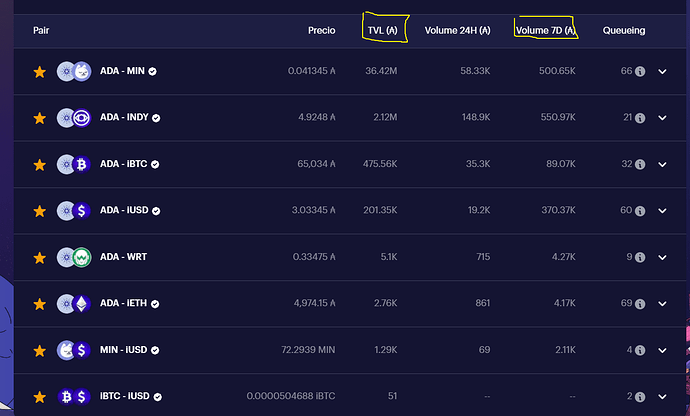

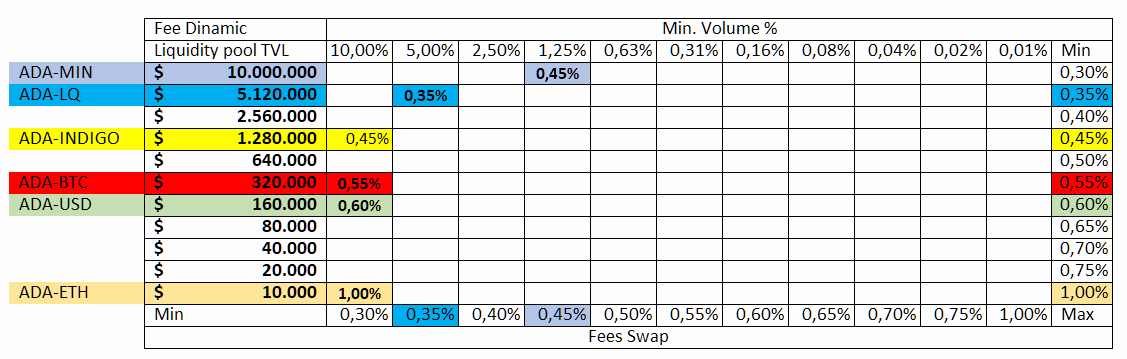

If you do not understand the image we will make an example with the liquidity and current volume in Minswap. all values will be in ADA

You can see that the MIN-ADA pool greatly exceeds liquidity, but it does not exceed the volume of the minimum 10%, rather the volume is a little more than 1.25% (the fee would be 0.45%). In ADA-LQ it exceeds TV and VOL and the reward for the minimum pool is 0.35%, if the volume is very low and the TVL is 0, the reward to incentivize providers rises sharply to encourage them to stay and wait for to increase. On the other hand, if the vol is high, but the tvl is very low, again the reward increases.

Option A

Option B

Another commission can be 1% if the volume is 0.02% and if it is less than 0.01% the commission can be 2% (you decide), if the volume is 0.01% and 0, 02%, liquidity providers earn virtually nothing, and could withdraw their funds. This is why I propose that the dynamic fee should be high with volume almost 0% otherwise the price impact can be much higher without liquidity providers.

The fees have to increase or decrease in a tiered manner, so that if a user makes a swap, they won’t be startled to see a fee of 0.34345, that doesn’t make sense. It’s better to aim for stability.

If I see that fee rate of 1% per swap and I have 10,000 in ADA and I can create the pool, for me it would be a great opportunity and a great gain without having to worry about farming gains. (That’s why one invests in DEXs)

Remember that if liquidity is very high, more than 100M, and volume is 1M, it will be taken into account the minimum volume value of 10M and not 100, because it wouldn’t make sense to promote a pool that already has liquidity.