In Minswap, soon the fees for all transactions will accumulate 0.05% to the ADA-MIN pool, increasing the liquidity of the pool and the liquidity holders of said pool will increase their returns. This will be positive for the MIN token to increase its market cap.

Sabiendo lo anterior, propongo algo diferente, pero manteniendo y agregando lo anterior, y es usar el poder del interés compuesto para almacenar más valor tanto en MIN-ADA, e incluso en otros tokens que no son ni ADA ni MIN, esta propuesta puede ser extendido a todos los fondos de liquidez para hacer que todos los tokens sean deflacionarios. Pero primero hablaremos brevemente sobre el interés compuesto aplicado en mi propuesta para ver cómo se implementaría.

Los titulares de liquidez ganan el 0,3 % de las tarifas de MIN-ADA, cuanto mayor sea el volumen de operaciones diarias, mayor será la recompensa para los proveedores de liquidez, si la participación de un usuario es del 0,1 % y el volumen diario fue de $63 000, gano $0,189, supongamos que añadiste liquidez y tu peso en el pool es del 50%, si el volumen vuelve a ser $63.000 habrás ganado $94,5, now you will have $63.095

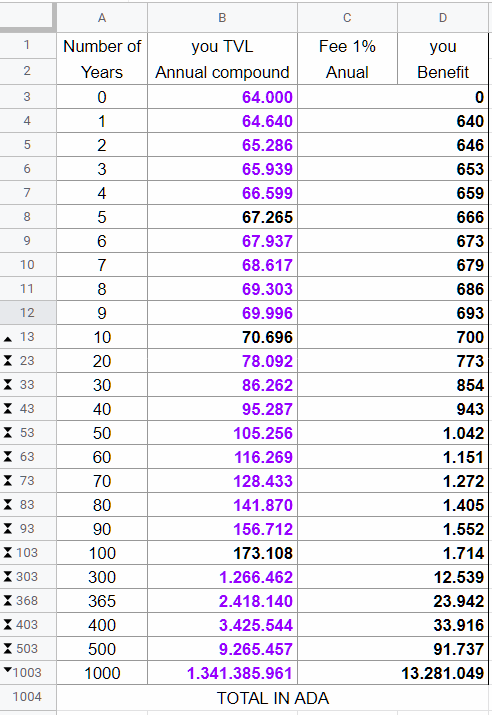

That being said, we will add compound interest to the liquidity holder who theoretically owns 0.1% = 64,000 worth of ADA in the MIN-ADA pool, assuming that daily volume provides liquidity providers with a constant 1% annual profit per 5, 10, 100, or 1,000 years of exaggerating, and no one backs out on this example.

The initial TVL was 64,000 ADA, in 10 years it would accumulate 70,696 value in ADA.This can be applied to all MIN swap pools.

No token is permanently removed from circulation in theory, by default the tokens will be in the smart contract pool, both tokens that are in the LP will be available forever to perform swap, but paying the fee that corresponds to the liquidity provider, in The previous example was 1%, but if it were 100%, 200% or 1000% in one day, there would be more tokens trapped in the smart contract. (WHAT IS BURNED OR WITHDRAWN FROM CIRCULATION IS THE LP TOKEN)

This would bring several benefits:

1-All liquidity pools would always have liquidity to carry out swaps

2-It is insurance for all token owners in case of crypto scams (LUNA, FTX as an example), or in case all liquidity holders decide to withdraw their coins.

3-It would add more value to all tokens, especially Cardano

A DeadWallet would be needed for this, and we would need to give said wallet LP tokens. I have a proposal that I will leave here but discuss it among all, if you like this proposal.

The proposals to send LP Tokens to the DeadWallet would be:

1-each time the tokens or pairs of an LP are unlinked, a minimum fee is charged, as if it were a SWAP, this increases the commitment of liquidity holders, that unlink fee would be 0.001%, if my liquidity was 1 Million ADA in the LP, 10 ADA would be blocked in the smart contract.

2-LP Donations, the community would see the DeadWallet and voluntarily contribute their own lp tokens.

3-SWAP fee, if 0.05% is for MIN-ADA holders, something similar, but to create LP and send it to the DeadWallet, that 0.3% fee would be allocated 0.01%

4-all of the above or what you propose