Hi all,

I’m bringing forth to you my findings regarding the current MIN/ADA liquidity pool. I know most of you are familiar with the important rule of DeFi why having adequate liquidity is important. This is to fight high slippage and uncontrollable price movement. But very few seem to know that the same rule applies both ways, a pool can also be too big, and this (I believe is the case for MIN/ADA).

What happens in the opposite scenario, is exactly the opposite of having too little liquidity, the volume subjected to the pool will simply do nothing to it = drowning all price movement.

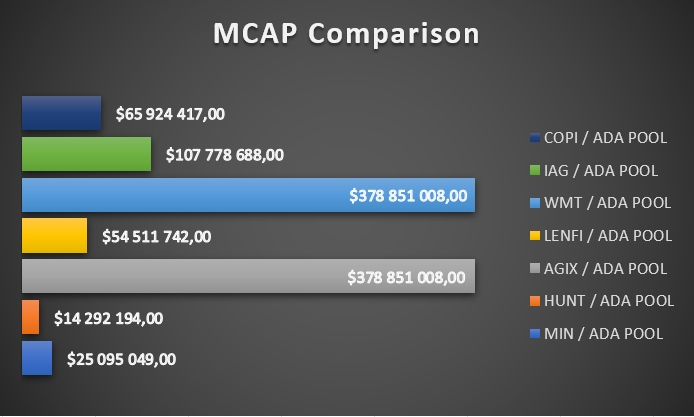

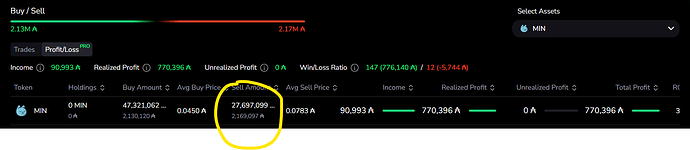

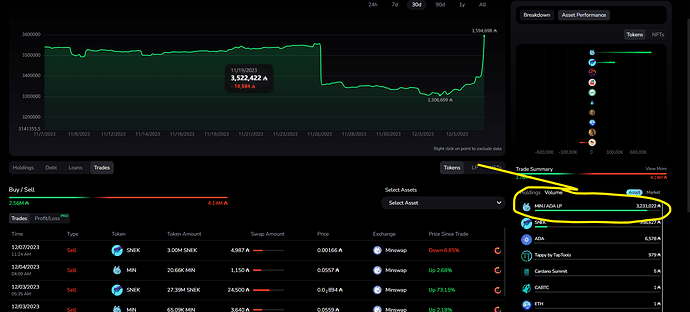

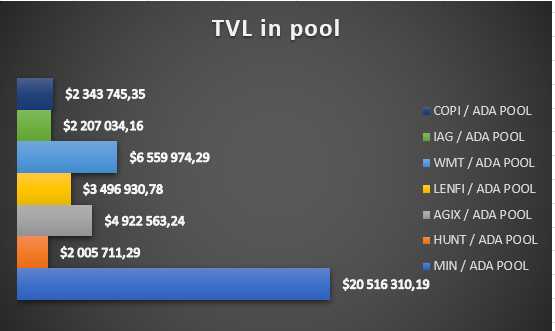

Current Situation: The MIN/ADA pool currently holds a substantial amount of liquidity, with a total value locked (TVL) of ~48 million ADA and a daily volume between 200k-500K ADA. While having a deep liquidity pool is advantageous, I believe the pool size might be disproportionate to the existing market and trading volume within Cardano. Under you can find a chart that compares some of the most known pools in Cardano. And as you can see Minswap has approximately a 8 to 10 times larger pool than even the largest projects in Cardano:

And here are the same projects compared by MCAP:

Now next I want to go over briefly the formula that runs most of DeFi

This formula is called the Constant Product Formula. In this formula, 𝑥 and y denote the total units in each asset, while k denotes their product. And k is always constant.

Using the example, it will look something like this –

Starting price for token X = 10

100 x 1000 = 100 000

The idea is that the product of the total units in each asset should always be the same regardless of their individual value. In other words, both assets should share a 50:50 ratio in total value.

So, if someone wants to buy 10 of token X, they must add roughly 111,11 of token Y to the liquidity pool to maintain the value of k.

Why?

90 * 1111,11 = 10 000

1000 / 90 = 1111,11

Price for 1 token X after purchase = 12,345 (1111,11/90)

As you can see, taking out ETH from the pool decreases its supply causing its value to go up, while adding more USDT increases its supply, further reducing its value to maintain the value of k.

A liquidity pool has a optimal size for it’s current market, usually CEX’s modify liquidity behind the scenes (obivously, because they are centralized), but this also means that it should also be done with decentralized projects. This is why LP provision is a service, and there are companies that do that for you (one example is JPG.store that used a 3rd party to handle their LP).

Now to the problem:

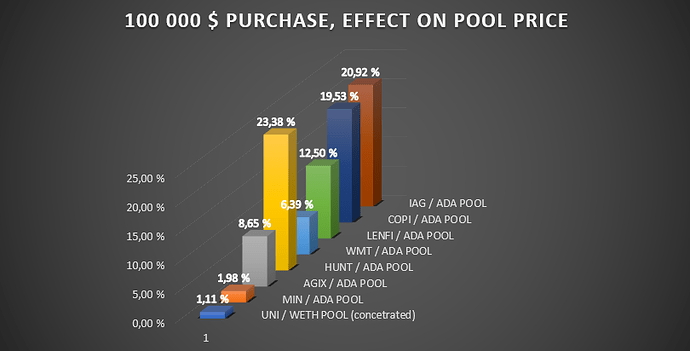

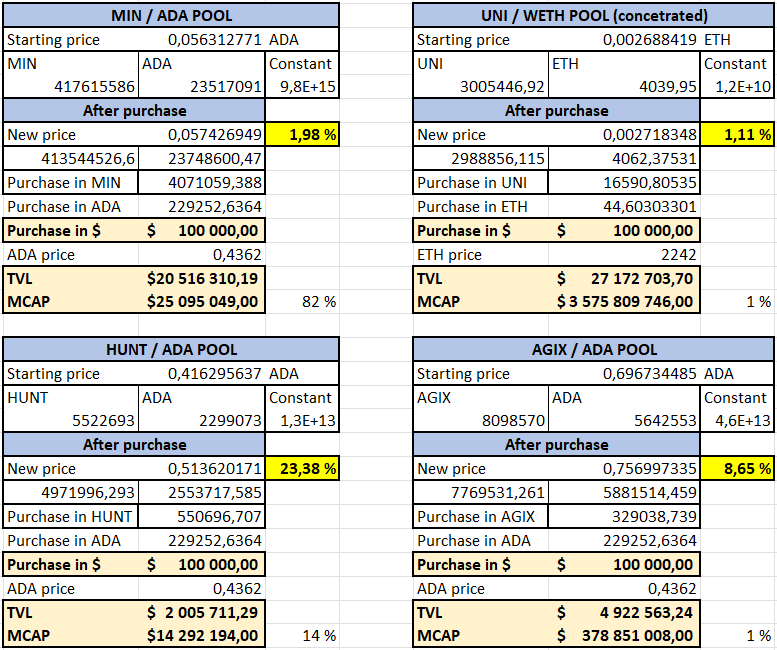

If we run a test through different Cardano pools (and I added Uniswap main pool for context), we can actually see what happens when a pool is too large for it’s own good.

In this test, we will test how a 100 000 $ single purchase will affect the pools price:

As we can see, we are in a situation where Min tokens price can not even be moved by 2 % with a 100 000 $ purchase, with almost a similar price movement to Uniswaps effect with a 3,5 Billion mcap.

Whereas a project x15 the mcap AGIX moves +8,65% with that same purchase and COPI with 3x the mcap, moves +19,53%.

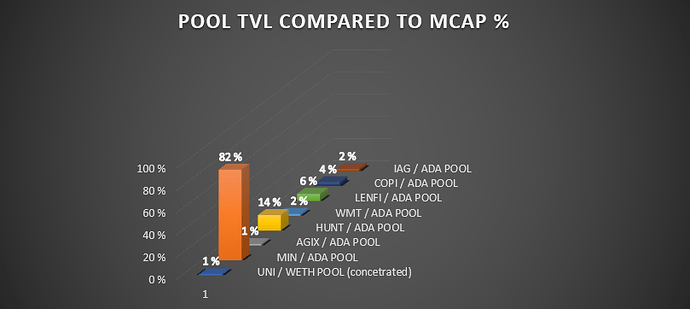

Here we have one more comparison of a pool TVL compared to it’s MCAP:

This picture is to show, that normally a pools TVL should be in the single digits % range compared to it’s total mcap, but in Minswaps case we are at 82%. And this brings us to our next important point:

Capital Inefficiency: Maintaining excessively high liquidity ties up a significant amount of capital that could be used more efficiently elsewhere, in this case hindering growth.

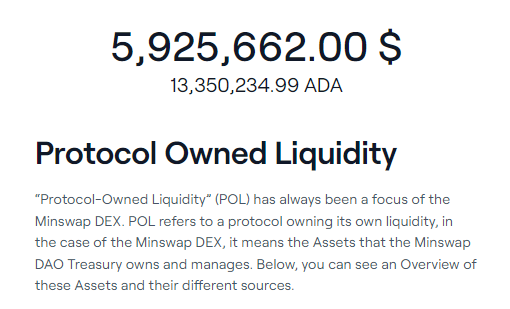

Right at this moment the protocol owns almost 6 million $ in TVL in the current pool that represents (about) 25-30% of the pools TVL.

Proposal: I propose a gradual reduction POL in the MIN/ADA pool by 50%, with the reallocated capital directed towards strategic initiatives. These initiatives could include, but are not limited to, CEX listings, marketing efforts, and community development. The objective is to strike a balance that ensures sufficient liquidity for smooth trading while unlocking capital for the growth and expansion of the Minswap ecosystem.

These tokens would go to the DAO, and could pretty much fund all needed CEX listings going towards the BTC halving and the next retail bull market.

Conclusion: Balancing liquidity in the MIN/ADA pool is crucial for having a healthy trading environment. By optimizing the pool size and reallocating capital strategically, we can position Minswap and the MIN token for better and sustained growth in the evolving market.

I look forward to a constructive discussion on this proposal for the benefit of the Minswap community.

Best regards,

Nilez

PS: here is a screenshot of the calculations. If anyone from the community wants me to send them the Excel file, pls DM me. I’m more than happy to share ![]()

Discord: dojonilez