Introduction

The Minswap Labs team has agreed to seed the MIN/ADA pool to help kickstart the Lenfi V2 protocol. But in order to further strengthen liquidity, we believe that it would be healthy for the overall ecosystem to use some of the DAO’s POL as a booster for the Lenfi V2 pool. Why Lenfi V2? Lenfi V1 has been on mainnet for a long time period and has become one of the most widely used Cardano DeFi platforms. Lenfi V2 introduces several improvements and is open sourced and audited.

Reasons for the proposal

An important concept within DeFi is capital efficiency, which is the measure of value a certain amount of liquidity can generate over time. In the case of Minswap’s liquidity pools, one way of measuring this value is comparing a pool’s TVL with its daily trading volume.

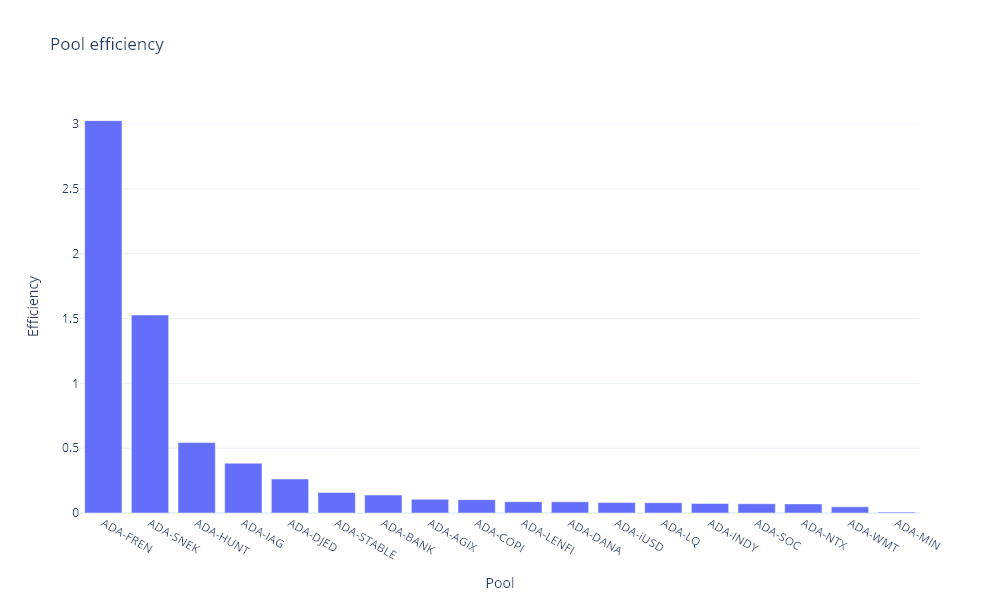

The following graph plots the ratio between the average daily volume (in ADA) and its TVL:

As can be seen, the least efficient pool in 2023 was MIN-ADA (which is highly incentivized) due to most of the liquidity not being utilized. Therefore we can conclude that TVL in the MIN/ADA pool is too high. Additionally, it could still function with less TVL and still have sufficient liquidity for trading activity.

In order to alleviate this issue, we believe some liquidity ought to be withdrawn and deployed in other strategies. The removal of Liquidity ought to be done gradually and carefully, through very thought-out Proposals that present valid options for the MIN/ADA capital once it is removed. This is the first step in that direction, and thus can be considered more of an initial trial.

Impact of the proposal

The following are some of the impactful consequences we can expect from this proposal:

-

Increased Trading Volumes:

Boosting borrowing/lending will eventually lead to increased trading volumes. Such an increase in trading volumes should signify a positive impact for Minswap. The target for the DEX in the long run is to have Trading Fees progressively become the larger part of the yield earned by LPs. -

A New Use Case for MIN:

Lenfi V2 enables leverage trading. This is important for traders who are willing to take greater risk for a potential higher reward. It may also become attractive for holders with lower funds by allowing them to acquire a larger position. -

Assurance to MIN holders:

By having a Pool backed by Minswap DAO Liquidity, MIN holders will have the assurance that there is enough Liquidity to trade MIN with leverage. This also prevents Liquidity fragmentation by giving all Minswap supporters who want to use leverage a common Pool to trade and provide liquidity. -

Stake Key Delegation:

Lenfi Pools enable control of the Stake Key delegation. It is important for the Minswap DAO to remain in control of this delegation as this Pool grows in the future. Currently Minswap Labs has control over the stake key, which has been directed towards the MIN Stake Pool. This Pool has 100% Fees, meaning all the ADA staking rewards are being distributed to LPs in the end. This may be changed by the DAO anytime. -

POL Diversification and increased Yield:

At Minswap, the current yield these MIN/ADA LP Tokens generate is 17.62%. The yield is in the form of MIN, ADA and Trading Fees. While the yield obtained by this MIN/ADA in Lenfi V2 is hard to forecast (having launched just weeks ago), LENFI incentives and yields from lending/borrowing activity will enable the DAO to diversify its source of yield. Additionally, current MIN/ADA farmers will initially enjoy a higher APR, due to rewards being distributed into a smaller share.

Risks of the Proposal

-

Lending/borrowing access to MIN enables users to short MIN:

Firstly, this is already available through other platforms that allow lending and borrowing of MIN.

Secondly, this can be mitigated within this proposal by looking into the ratio the DAO is willing to provide as collateral/borrowable tokens. -

Higher volatility for MIN Token:

Active lending/borrowing markets entail a higher volatility for an asset as it is linked to an increase in Trading Volume. There are ways for the DAO to take advantage of increased lending/borrowing, such as increasing the Fees on the MIN/ADA LP on Minswap V2 (but that’s another Proposal). -

Smart Contract exploit:

Such a risk has been addressed through an audit of Lenfi V2 but it can never be fully prevented. -

Less MIN/ADA Liquidity:

Out of the options that are being proposed, the maximum liquidity removal would be of 100k ADA and 100k ADA worth of MIN. That is q only 0.44% of the MIN/ADA poolTVL and 1.47% of the Minswap DAO owned liquidity. We do not expect a significant impact from this liquidity being removed.

Use Case Example:

When the Minswap DAO deposits MIN as a DAO, it will earn interest rates on this deposit and any stake pool rewards accrued due to collateral staking (someone has to lock ADA as collateral).

When it deposits ADA as a DAO, it will have the same as above, but additionally the MIN token will get extra utility to be used as a collateral in a liquid pool. Leveraged trading is the easiest use case.

Example:

-

Have 10k ADA.

-

Buy 10k ADA worth of MIN.

-

Deposit 10k ADA worth of MIN as collateral take a loan of ~6k ADA

-

Buy 6k ADA worth of MIN

-

Deposit 6k ADA worth of MIN as collateral take a loan of ~3.7k ADA

Voting Options

It’s important to consider how we ratio this liquidity. The more borrowable ADA in the MIN/ADA Pool we deposit, the easier it would be to leverage long MIN. The more borrowable MIN we deposit, the easier it will be to leverage short MIN.

We propose different ADA and MIN amounts to be removed from MIN/ADA Liquidity from the Fee Switch (containing roughly 521k ADA and 8.6mn MIN).

Therefore the options would be the following:

1. 100k ADA and 100k ADA worth of MIN

2. 100k ADA and 50k ADA worth of MIN, in which case the remaining MIN would be transferred to the DAO wallet.

3. 50k ADA and 50k ADA worth of MIN

4. Do not remove POL to provide in Lenfi V2.

Authors: CWSchub, PurritoGeneral

Should this proposal go on-chain?

- Yes

- No