Background

There has been lots of discussion recently within the Minswap community regarding $MINomics. The overall sentiment is that $MIN as a token lacks a use case and a role within the platform. $MINomics V2 was envisioned as a series of changes to strengthen the use case of $MIN within the Minswap protocol. The first of these changes is deciding on the future of the Fee Switch.

The Fee Switch refers to the 0.05% of swapping fees paid on the DEX. These are currently used to zap that $ADA into $MIN/$ADA LP Tokens which go to the DAO Treasury. As such, the Fee Switch is currently being exclusively directed towards one aim: to increase DAO owned $MIN/$ADA Liquidity. With this Liquidity being close to 14.5mn $ADA worth currently (August 2023), the case can be made to commence directing the Fee Switch towards another aim.

Option 1 - Directing Fee Switch $ADA towards other Assets

In the original Fee Switch post two options were laid out, to focus on increasing Liquidity on the $MIN/$ADA Liquidity Pool, or to focus on using the Fee Switch $ADA to a wider range of LPs (such as Tiger Farm assets like $WMT, $MELD, $LENFI, etc.). The focus on the $MIN/$ADA liquidity strategy won, likely because having a strong $MIN/$ADA Pool especially in earlier stages of the project is incredibly important.

As the Minswap protocol grows and matures, it might be worth exploring other options to increase and diversify the DEXs Protocol Owned Liquidity (POL). At the time the Fee Switch vote was done, there were no stablecoins on Cardano. There currently are options such as $DJED and $iUSD or incoming ones like $USDM and $USDA. With the incoming launch of the Minswap Stableswap, it could be interesting if the protocol owned stablecoins and provided them in the Stableswap to earn yield on them. Another option would be if Fee Switch $ADA would be used to acquire shares of “blue chip” Cardano assets in their $ADA Liquidity Pools such as $LENFI, $WMT, $MELD, etc.

It is to be noted that when it comes to Protocol Owned Liquidity (POL), there are other ways to acquire it such: the Launchbowl service (used by projects to bootstrap liquidity, the projects pay a share of their LP as a fee) and Batcher Fees (which starting August will begin to be distributed 50% to the DAO Treasury).

If this Option is chosen, it would be necessary to conduct a second vote to evaluate whether to focus on Stablecoins, on other assets, or both.

Option 2 - Directing Fee Switch $ADA towards $MIN stakers

In the original $MINomics article, we evaluated the staking model of DEX Tokens that was trending then. This model had two main issues:

-

The staking of doesn’t have any real purpose: unlike staking $ADA in the Cardano network (where you contribute to the validation of blocks), in the case of DEX tokens where one can stake to get more of the DEX token, the staking does not have any necessary function in the protocol.

-

Misaligned incentives: the idea that fees collected from swappers are used to buy the DEX token on the open market to increase the buying pressure and then given to stakers, is usually counterproductive. Because this means that for stakers, there’s no way to take profits from staking the DEX token except to just sell it.

Both of these issues can be solved through the following:

- Require $MIN stakers to “soft-lock” their $MIN for a certain amount of time: by locking up $MIN for a certain amount of time, $MIN stakers assume an economic risk. It benefits the protocol as this $MIN remains out of circulation. It’s a “soft-lock” in that you may unlock your $MIN at any time, however doing so early means you would forfeit your accrued rewards. Forfeited rewards from early unstaking would be distributed to the other $MIN stakers.

In order to accommodate different risk profiles, the staking periods could be 1 month, 3 months, 6 months or 9 months. Each period should have a different boost on rewards, so that the longer you stake, the more your rewards are boosted. The boosts would work the following way:

1) Staking $MIN for 1 month - gives an unboosted $ADA APR

2) Staking $MIN for 3 months - gives a 3x boosted $ADA APR

3) Staking $MIN for 6 months - gives a 6x boosted $ADA APR

4) Staking $MIN for 9 months - gives a 9x boosted $ADA APR

- Distributing rewards directly in $ADA: rewards to $MIN stakers should be distributed strictly in $ADA and not $MIN. This way $MIN stakers wouldn’t need to sell $MIN to capitalize on their yield, they could directly claim $ADA. It’s important to highlight that this way $MIN stakers earn Real Yield directly coming from Swap Fees, in $ADA. It doesn’t consist of inflationary rewards, it’s purely coming from organic Trading Volume. Note that the Fee Switch $ADA Revenue would exclude that coming from the $MIN/$ADA Pool in irder to avoid selling $MIN for $ADA to rewards $MIN stakers.

So, how would these $ADA Real Yield rewards look like?

Here is the approach we took to estimate them:

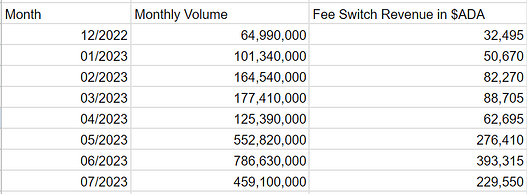

First, taking $ADA generated from the Fee Switch data from December 2022 (when the Fee Switch was activated) until July 31st. The average number will be taken to estimate the annualized $ADA earned.

Second is assuming how much of the circulating $MIN gets staked, and how much gets staked for each particular staking period. This data is hard to estimate. We are assuming the higher % towards longer staking periods as they have more boost:

MIN Staked (% of circulating) = 55% (given around 45.5% of circulating $MIN is in $MIN/$ADA LP)

Staked $MIN for 1 month - 20%

Staked $MIN for 3 months - 20%

Staked $MIN for 6 months - 30%

Staked $MIN for 9 months - 30%

With those assumptions, here are the APR based on Historical data:

Staking $MIN for 1 month = 0.982% $ADA APR

Staking $MIN for 3 months = 2.947% $ADA APR

Staking $MIN for 6 months = 5.894% $ADA APR

Staking $MIN for 9 months = 8.842% $ADA APR

Making these assumptions is not an exact science, and it’s nearly impossible to predict how $MIN stakers will behave. As such, we are making public the calculator for anyone to estimate $ADA APR for staking $MIN for different scenarios:

Please also be mindful that these are historical numbers based on the Fee Switch $ADA revenue earned from December 2022 to July 2023, it does not ensure similar future returns.

Option 3 - Keep directing the Fee Switch towards accumulating $MIN$ADA LP

The third option is to keep things as they are now redirecting the Fee Switch towards accumulating MIN/ADA LPs. This option would be to continue prioritizing the $MIN/$ADA LP through the “soft-buyback” mechanism where $ADA from the Fee Switch is used to Zap into this Pool periodically.

Should this vote go on-chain?

- Yes

- No