Summary

The Fee Switch consists of directing 0.05% of the 0.3% Variable Fee swappers pay towards increasing Minswap’s POL (Protocol Owned Liquidity). Every epoch, assets accumulated from the Fee Switch are to be deployed. Bear in mind, assets accumulated from the Fee Switch come in the form of LP Tokens (if you are curious about the logic, please read Section 2.4 on the Uniswap V2 Whitepaper) .

In short, there are two Options proposed to the DAO to vote on the use the assets derived from the Fee Switch:

- Option 1: focus on MIN/ADA LP:

- Every hour, any LP Tokens accumulated through the Fee Switch that aren’t $MIN/$ADA LP Tokens and that are worth more than 100 $ADA are sold in the open market for $ADA. For example, if 100 $ADA worth in $LQ/$ADA LP Tokens was accumulated, the 50 $ADA worth of $LQ would be sold for $ADA.

- The rest of LP Tokens worth less than 100 $ADA are kept and accumulate until they reach the value of 100 $ADA.

- Any $ADA generated are zapped into $MIN/$ADA LP Tokens.

- $MIN/$ADA LP Tokens are farmed.

- Option 2: focus on overall LPs:

- Every hour, a set of tokens (in the form of LP Tokens) from a basket of tokens that are worth more than 100 $ADA are retrieved from the Fee Switch Wallet and Yield Farmed.

- At the beginning, the basket of tokens could for example consist of all Tiger Farm Assets ($MELD, $WMT, $LQ and $AADA).

- The rest of LP Tokens received are to be sold for $ADA if their balance is more than 100 $ADA worth. Any $ADA generated is zapped into $MIN/$ADA LP Tokens and LP Tokens are farmed.

We encourage discussion on the topic and suggestions for improvements before submitting the Proposal to on-chain Governance.

Introduction

In a recent Proposal, the DeFi-savvy Minswap Kitty Farmer @marco_112358 advocated for the activation of the “Fee Switch”, arguing why, and how that could be structured. Given our on-chain Governance module is ready, it is important to kickstart a discussion and elaborate a coherent structure to present to $MIN holders and LPs to vote on.

As you might now, every time someone swaps an asset on Minswap, they pay 2 fees:

- A Variable 0.3% Fee of the asset they are selling which goes to Liquidity Providers. So currently, each swap incurs a 0.3% fee that the swapper must pay. Liquidity Providers in the respective Pair of assets being traded receive this 0.3% fee pro-rata. For example, if you swap 100 ADA for MIN, you get 99.7 ADA (minus slippage) worth of MIN, and collective Liquidity Providers get the other 0.3 ADA.

- A Fixed 2 $ADA Fee (or less, depending on their $MIN Discount they qualify for) which goes to the Minswap DAO Treasury.

The Fee Switch affects the 0.3% Variable Fee swappers pay. It can be turned on to redirect 0.05% of the 0.3% of each swap to a Treasury/Fee Switch wallet, while allowing the other 0.25% to continue to go to Liquidity Providers.

Aim of the Fees

While collecting this Revenue from the Protocol perspective is attractive, it should only be done insofar as it is under a coherent structure. In particular, we believe Revenue collected from the Protocol should be used towards 2 main objectives:

- To continue to fund development (audits, hiring, infrastructure, etc.).

- To grow Minswap’s Protocol-Owned-Liquidity (POL).

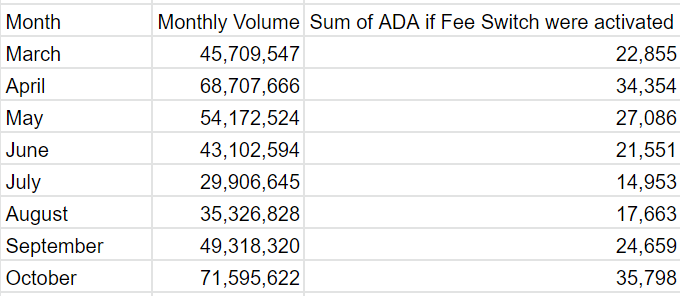

Before going into more detail, here is some data on the $ADA that would have been collected from these revenue sources for the last 8 months:

In a previous article, we talked about Fee Sharing, its disadvantages and how it ought to be implemented to overcome them. Minswap is at an early stage, where there are significant costs related to audits, hiring, and infrastructure. As 0xSami put it in a recent article: “for the premature (nearly all projects), the choice to point those fees to the token holders instead of the DAO will cause some issues to arise.”

As such, we believe that in the short-term, the Fee Sharing should be divided into two streams:

- Batcher Fees: to be used fully in the short-term to fund development.

- Fees from the Fee Switch (Variable Fee:) to be fully redirected in a framework that grows Minswap’s POL.

Structure for using Variable Fee to grow POL

We propose structuring the flow of fees from the Fee Switch in 2 different Options, for the DAO to evaluate and choose one.

- Option 1: focus on MIN/ADA LP:

- Every hour, any LP Tokens accumulated through the Fee Switch that aren’t $MIN/$ADA LP Tokens and that are worth more than 100 $ADA are sold in the open market for $ADA. For example, if 100 $ADA worth in $LQ/$ADA LP Tokens was accumulated, the 50 $ADA worth of $LQ would be sold for $ADA.

- The rest of LP Tokens worth less than 100 $ADA are kept and accumulate until they reach the value of 100 $ADA.

- Any $ADA generated are zapped into $MIN/$ADA LP Tokens.

- $MIN/$ADA LP Tokens are farmed.

- Option 2: focus on overall LPs:

- Every hour, a set of tokens (in the form of LP Tokens) from a basket of tokens that are worth more than 100 $ADA are retrieved from the Fee Switch Wallet and Yield Farmed.

- At the beginning, the basket of tokens could for example consist of all Tiger Farm Assets ($MELD, $WMT, $LQ and $AADA).

- The rest of LP Tokens received are to be sold for $ADA if their balance is more than 100 $ADA worth. Any $ADA generated is zapped into $MIN/$ADA LP Tokens and are farmed.

Option 1 revolves around using Fees to strengthen the Liquidity in the MIN/ADA Pool. Having a strong MIN/ADA Pool, especially in earlier stages of the project, is incredibly important as we highlighted in our LBE article. Option 2 is more geared towards increasing and diversifying the Minswap POL over a basket of assets instead of focusing on MIN/ADA Liquidity. While the basket of assets proposed are Tiger Farm Assets ($MELD, $WMT, $LQ and $AADA), if Option 2 is chosen it would be necessary to also consider, evaluate and vote on different options for the Basket of Assets.

Should this Proposal be submitted to on-chain Governance?

- Yes

- No

0 voters