Introduction

When the MIN Token first entered circulation, 0.5% of total supply (25mn MIN) was released without vesting and lockup. Many different initiatives were set in motion since then to fairly distribute MIN tokens and decentralize token ownership (FISO, Incentivised Testnet, Yield Farming…). However, this initial low float conditioned the tokenomics design from the beginning, allocating 3% of MIN supply towards the LBE and 5% towards the first 6 months of farming.

At the time the MIN Token was created, it was with an open policy. The reason behind that decision is that tokenomics is an extremely complicated area. Nailing token design on the first iteration is unlikely, and as such it is better to remain adaptable.

With this proposal, we aim to leverage that adaptability by proposing a MIN Token burn that will address some of the concerns voiced by the Minswap community in the latest months.

Background

There has been lots of discussion recently within the Minswap community regarding $MINomics. $MINomics V2 was introduced to revamp $MIN tokenomics, listening to the community feedback in an attempt to make the platform better overall. The following improvements were made as part of $MINomics V2:

- Redirect the Fee Switch ADA towards MIN stakers, so they can stake MIN and earn ADA.

- Directing 50% of Batcher Fees towards the DAO Treasury, which has accumulated to date 335,733 ADA.

- Cut down on Emissions significantly from 670,609 $MIN daily since $MINomics V2 started in July 2023 to 358,793 MIN daily (-46.5%) now in December 2023.

The long term aim of the DEX has always been to not entirely rely on Emissions, but rather have Trading Fees progressively become a bigger part of the yield earned by LPs. This has already been happening, as you can observe that a large portion of Liquidity Pairs on Minswap (such as ADA/DJED, ADA/SNEK, ADA/LENFI) have a majority of the yield coming from Trading Fees instead of MIN emissions. Minswap V2 will play a big role towards moving in this direction, Dynamic Fees will enable LPs to adapt better to market conditions, and to profit more from trading fees paid by traders swapping.

This shift towards sustainable yield also aims to transform MIN from being a token held as a reward for farming, to being a token held for its utility. The MIN token is to become a scarce resource, with trading fees distributed to stakers, utility within the platform, and a pivotal role in Governance both within Minswap but also the Cardano ecosystem as a whole.

Reasons for a MIN Burn

With almost 2 years since mainnet launch, we think now is the time for the DAO to decide on another important vertical that an open token policy enables: whether or not to burn MIN and how much to burn. But first, here are the reasons why we believe a burn is necessary:

-

Low Float and Clarifying Maturity Indicators - at 20.4% supply circulating, the MIN Token has a relatively low float compared to other DEX tokens. This is an issue as it does not represent the stage of the project (with Team Tokens almost halfway distributed, 2 years of mainnet and farming, etc.). With Emissions decreasing steadily for the last 6 months (-46.5%), Minswap has been on a path of relying less and less on MIN Farming incentives in order to attract liquidity and volume.

-

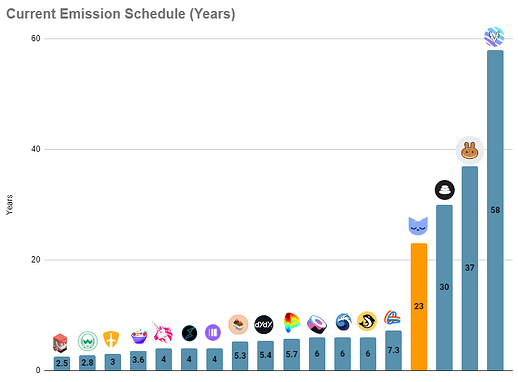

MIN Farming Token surplus - there has been significant research over the last months put into this proposal. A community member (Chicken) wrote up a DEX Emissions Schedule Study to determine the most optimal duration for the yield farming schedule. At the current rate (which is set to keep decreasing) the schedule would last for the next 25 years, significantly higher than industry standards. The study uses a variety of metrics to determine the Optimal Duration Based Supply Analysis, and concludes with it being around 9 years.

This leads to an inefficient resource allocation, as it is not prudent to predict timelines that are well beyond our control. Rather, it is better to run a tight ship and prioritize efficient allocation of resources as to influence a timeline that is within our control and garner further adoption at an early stage.

- Community sentiment - Minswap prides itself on being a community-first project. There has been much debate recently within the community about the relevance of the circulating supply in relation to the total supply of tokens. An overwhelming majority of community members have expressed that the tokenomics of Minswap are something that they would like to see fixed. This would assuage these concerns and also make way for more positive sentiment regarding Minswap.

Burn Mechanics

While tokens could be burnt over a period of time, we think that a one time, significant burn is more effective. Not having to spend valuable resources to discuss the particularities of a burn over time allows for more time to concentrate on other DAO Governance initiatives such as more efficient management of Protocol Owned Liquidity, CEX Listings, Catalyst voting, adding MIN rewards to MIN staking and more.

We have established why burning a significant amount of MIN from Yield Farming would make most sense given the surplus. However, if the intention is to make MIN a scarce Token, it should be scarce for the Minswap Labs Team as well. It would be unfair to burn a very significant amount of community tokens from yield farming to optimize tokenomics, without Minswap Labs being held to the same standards of efficient resource allocation as well. Thus, we propose that Tokens be burnt both from the Yield Farming allocation and the Development Fund. Development Funds are MIN tokens allocated to Minswap Labs that have so far been used to reward community managers and pay bonuses and are mostly reserved for once the Minswap Labs Team tokens have fully vested in March 2025. With Dev Fund Tokens being reduced, so will the future MIN token vesting for the Minswap Labs Team members.

Minswap is fortunate to be a community funded and focused project, there are no tokens owed to VCs or private investors. MIN tokens are fully owned by the community, as such adjusting tokenomics, token allocations and total supply is straightforward if the community approves. However, we would like to clarify 3 things:

- Modifying the total token supply is not a topic that we foresee revisiting again in the near future. Our goal is to properly allocate resources and not to give the community an idea that this is a common theme of proposals for the future.

- An open policy ID for the MIN Token shall not remain standard in the future.

- Further burns (if implemented) should follow a model where burning of MIN is correlated with economic activity on the DEX ($MINomics V3?). For example, Crypto.com periodically burns a % of the rewards from the inflation allocated to validators.

Options for voting

There are different options for voting so as to have as many community members be represented by the options as possible. With that being said, let’s dive into the Options for voting on this Proposal.

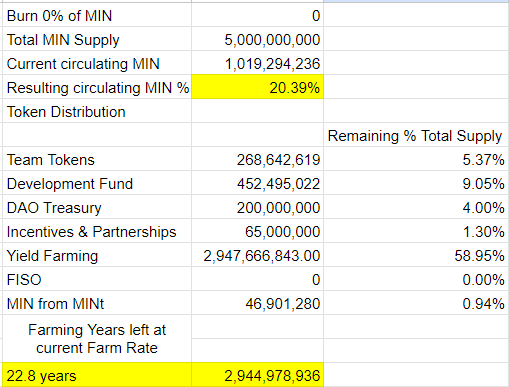

Option 1: No burn

In this Option, Tokenomics would remain as they currently are. The MIN left for farming could last for around 22.8 more years at the current rate until fully used. Development Fund MIN would remain fully as it is currently.

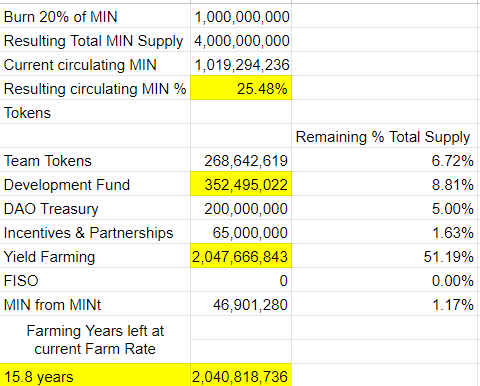

Option 2: Burn 20%, 18% from Yield Farming and 2% from Dev Fund

In this Option, the Dev Fund would be decreased from 452,495,022 MIN to 352,495,022 (22.06% drop) and the Yield Farming MIN would decrease from 2,947,666,843 to 2,047,666,843 (30.52% drop). The MIN left for farming could last for 15.8 more years until fully used.

Resulting circulating supply would be: 25.48%

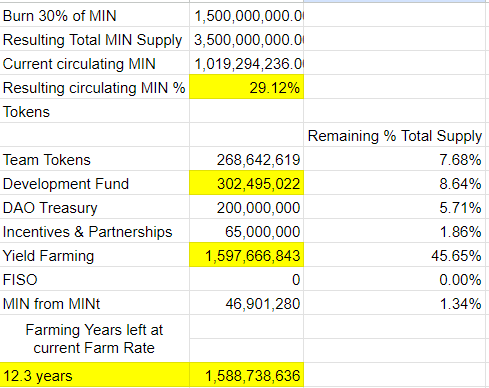

Option 3: Burn 30%, 27% from Yield Farming 3% from Dev Fund

In this Option, the Dev Fund would be decreased from 452,495,022 MIN to 302,495,022 (33.15% drop) and the Yield Farming MIN would decrease from 2,947,666,843 to 1,597,666,843 (45.79% drop). The MIN left for farming could last for 12.3 more years until fully used.

Resulting circulating supply would be: 29.12%

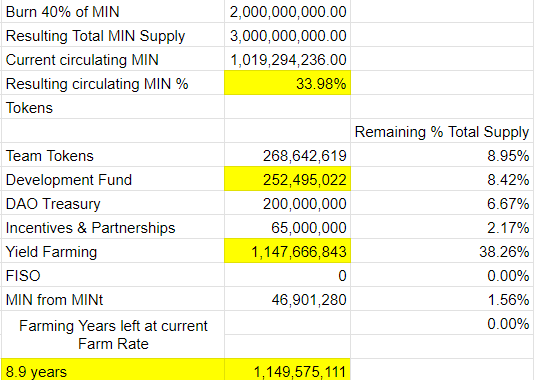

Option 4: Burn 40%, 36% from Yield Farming and 4% from Dev Fund

In this Option, the Dev Fund would be decreased from 452,495,022 MIN to 252,495,022 (44.19% drop) and the Yield Farming MIN would decrease from 2,947,666,843 to 1,147,666,843 (61.06% drop). The MIN left for farming could last almost 8.9 more years until fully used.

Resulting circulating supply would be: 33.98%

The option with the most votes amongst the 4 will be implemented.

Please vote in the Poll below for this Proposal to proceed to an on-chain vote.

Authors: PurritoGeneral, Ch!cken, Cardano Farmer, Nilez

- Yes

- No