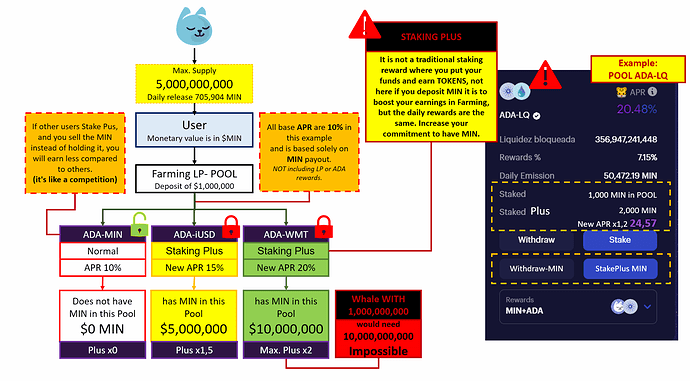

My proposal, “Staking Plus: Boost your farming rewards” is to create a staking function on a DEX where users can deposit their MIN in a pool of their choice. However, unlike traditional staking systems, there will be no direct rewards in MIN. Instead, the reward will be to increase the reward obtained in the farming pool where the staking is taking place. The formula to calculate the reward would be something like this:

Reward in the pool = (Base Reward in the pool) x (Pool Multiplication Factor)

Where the pool multiplication factor is established according to the amount of MIN staked in relation to the total MIN staked in that pool. For example, if a user has 10 times more MIN staked in a pool ADA-MIN than another user, his reward in that pool could increase by 100%, that means it would go from a 20% APR annually to a 40% APR annually. If a user has 5 times more MIN staked in a pool AADA-ADA than another user, his reward in that pool could increase by 50%, that means it would go from a 15% APR annually to a 22.5% APR annually. And if a user has 2 times more MIN staked in a pool iUSD-ADA than another user, his reward in that pool could increase by 20%, that means it would go from a 10% APR annually to a 12% APR annually.

The goal of this proposal is to promote the retention of MIN tokens and increase liquidity in the farming pools. By staking, users have an incentive to hold onto their tokens instead of selling them, which would help stabilize the price and improve the user experience. Additionally, by increasing liquidity in the pools, the efficiency and security of the DEX would also be improved.

It is important to note that in this proposal, staking would only be done on one pool at a time, not all pools simultaneously. This means that a user would have to choose which pool they want to stake in and lock their MIN in that specific pool.

By doing this, we aim to increase liquidity in a specific pool and not distribute the staking across multiple pools at the same time.

Users who stake their tokens can be called “Stakers Plus”, as they would get a plus in their rewards in the farming pools. With this, we aim to motivate users to retain their tokens and increase liquidity in the pools, which in turn would improve the stability and efficiency of the DEX.

Let’s say a user has staked 10,000 MIN in the ADA-MIN pool, and the total MIN staked in that pool is 100,000 MIN. The base reward in that pool is 20% APR annually.

Pool Multiplication Factor = (MIN staked by user) / (Total MIN staked in pool) = 10,000 / 100,000 = 0.1

Reward in the pool = (Base Reward in the pool) x (Pool Multiplication Factor) = 20% x 0.1 = 2%

So the user’s reward in the pool would be an additional 2% APR on top of the base reward, for a total of 22% APR annually.

Please note that this is just an example, the percentage, and the way to calculate the reward may vary depending on the specific implementation.

Example

The coin release would remain the same for all pools in farming. Again, there is no staking that pays more for having more MIN, the reward comes from the same farming process in the protocol. The user chooses which pool and how much MIN they want to link to, but the more MIN they commit, the higher the yield will be, which increases the amount of MIN in that pool. If the user decides to sell their MIN, others can use them to increase their yields. This can boost the liquidity of MIN and any pool.