Minswap: Proposal

Without mentioning the proposal, one issue that MINSWAP may face is a lack of utility for the token MIN. If users are not incentivized to hold and use MIN, they may choose to sell it or not acquire it in the first place. Additionally, there may be a lack of commitment from users to maintain their LP tokens in the protocol, leading to a decrease in liquidity and potential loss of users. Without a way to earn additional rewards through LP tokens, the overall growth and success of the protocol may be hindered.

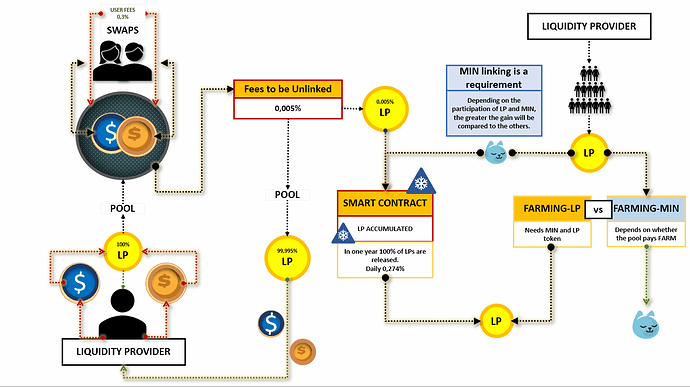

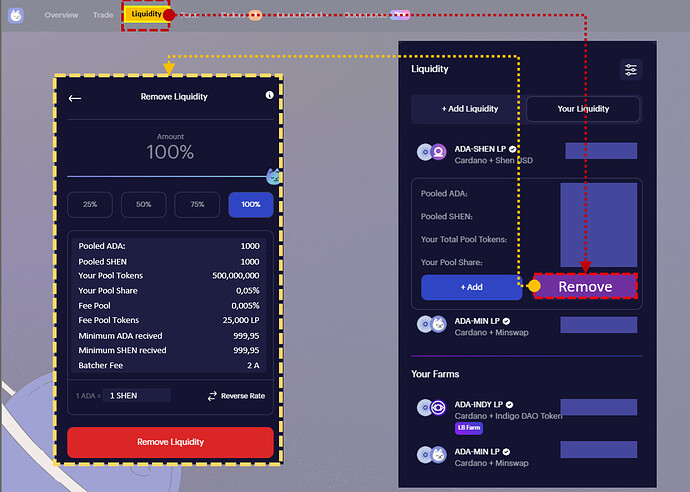

My proposal consists in adding a new form of reward in the MINSWAP protocol. Instead of paying the farming rewards only with the MIN token, it is proposed that a percentage of these rewards be paid in LP tokens. These LP tokens come from an accumulation stored in a smart contract and are released over a period of 1 year among the FarmingLP participants, which is different from the other farming that pays in MIN. Users who earn LP would have the option to unlink or keep these LP tokens. Additionally, for the contract to accumulate these LP, it is recommended that people who link and unlink assets in the protocol pay a fixed fee in LP tokens, but with a very low impact for liquidity participants at the time they unlink their assets. This fee in LP would be chosen by the community among 3 options 0.01%, 0.005% or 0.025% (suggestions are welcome). With this proposal, we aim to increase the utility of the MIN token and give more rewards to liquidity holders in the protocol, while also increasing commitment to not unlink the token. This fee would only apply to those who withdraw, not those who deposit their participation in the LP.

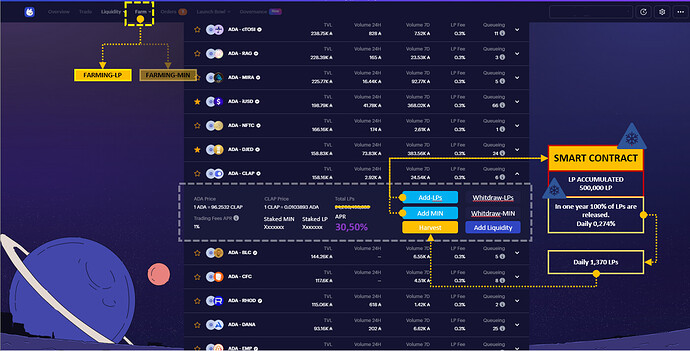

To implement this proposal, a smart contract would be implemented that accumulates the LP tokens of the users. This contract would be responsible for registering and storing the LP tokens generated through the fees paid by the users when linking and unlinking assets in the protocol. The smart contract would also be responsible for releasing these LP tokens over a period of 1 year (0.2739% per day) among the LP participants, the users should look for the profitable pool in the MINSWAP app, (the user will be solely responsible for the quality of the pairs he links). Once the pool is selected and with the LP tokens, the user would have to use MIN as if it were Staking or Farming to start the release of these LP tokens. This release could be proportional to the time and amount of LP tokens and MIN accumulated by the user. Similarly to the Farming. Given that the list of tokens for LP Farming would be extensive, I propose that the LP rewards be visible if they have a TVL of over 500 ADA. If there are already Users who have that link, they would be the only ones who could see such a pool with a TVL less than 500 ADA(if possible with all existing and future assets it would be better). In this way, we seek to increase the utility of the MIN token, and if the profitability of LP tokens is greater than MIN, it would boost the protocol with these additional rewards to the LP participants, while also increasing the commitment of users to maintain their LP tokens in the protocol.

The implementation of this proposal would bring several benefits. One of the main benefits would be the increase in utility for the MIN token. By allowing users to earn rewards for holding LP tokens, it would incentivize them to accumulate and hold onto MIN, which would increase its value. Additionally, by allowing users to earn rewards for holding LP tokens, it would increase the overall liquidity of the protocol, which would make it more attractive for traders and investors. This, in turn, would drive more adoption and usage of the protocol, which would further increase the value of MIN.

Another benefit of this proposal would be the increased engagement and commitment of users to the protocol. By giving users a tangible benefit for holding LP tokens, it would encourage them to participate in liquidity provision and actively manage their LP tokens, which would lead to a more stable and robust liquidity pool.

Finally, this proposal would increase transparency and trust within the protocol. By making the rewards for holding LP tokens visible to all users, it would give them a better understanding of the potential returns they could earn by participating in liquidity provision, which would make the protocol more attractive to new users.

Overall, the implementation of this proposal would increase the utility and value of the MIN token, increase the liquidity and adoption of the protocol, and increase engagement and trust among users.

In conclusion, it is proposed to implement a smart contract that allows to accumulate LP tokens generated through the very low fees paid by users when un-linking assets on the MINSWAP protocol. This contract would also be responsible for releasing these LP tokens over a period of 1 year among LP participants who possess the MIN token, increasing the utility of the MIN token and improving the profitability of the protocol. Additionally, LP tokens will accumulate swap fees and these will be accumulated in the smart contract until they exceed 500 ADA in TVL and someone claims them, releasing the LP gradually. The LP tokens are all the pairs created on the Protocol.

Option 1: 0.025%,

Option 2: 0.010%

Option 3: 0.005%

Option 4: Proposes the community

Note: This proposal would be a complement to my other proposal if approved, the user would decide between Farming using Staking Plus with the MIN token, or using his MIN to receive LP Tokens.

Note: This proposal would be similar to an Airdrop but in Farming.

Examples:

You can see my other proposals: